BINGHAMTON – In November 2019, a multi-million dollar transaction in student rental housing on Binghamton’s west side went completely unnoticed and unreported.

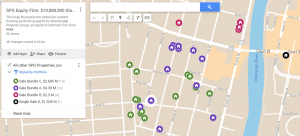

Over three days that month, Stonebridge Property Group (SPG), a private equity firm from New York City, acquired 34 Binghamton properties—33 residential properties on the west side in the “college housing district” and one downtown property—for nearly $11 million dollars.

The total assessed values of the 34 properties—the amount that determines the local property tax bill—is only about $2.55 million.

Why is a NYC equity firm paying 400% more than the assessed values of rental properties on Binghamton’s west side?

Or, an even more important question: why are property assessments in Binghamton so outdated, which grossly undervalues student rental and downtown properties?

Unpacking this question sheds light on troubling trends in Binghamton’s real estate markets, and how the inaction by local officials to fix our broken, inequitable assessment system (1) harms our homeowners and most other property owners by forcing them to pay higher property tax bills than are needed, (2) incentivizes small mom-and-pop landlords and corporate investors to convert more of our rental housing stock to student housing, charging by the bed, which as a result, (3) makes it much harder for non-students, like local families and individuals on limited monthly budgets, to find decent, affordable rental housing.

The first part of this article will provide more details on the real estate acquisitions by this NYC equity firm. The second part of this article discusses how this massive investment by an outside corporate entity exposes the inequities of our broken, outdated property assessment system (and how the majority of homeowners are subsidizing the obscene profits of these investors by paying more than our fair share of taxes). The third part of this article offers a hypothetical scenario of how a citywide revaluation in Binghamton could impact three different property owners (spoiler alert: if you’re not a landlord of student rental properties or a wealthy downtown developer, you’re going to like it).

Part 1. The Transactions of a NYC Equity Firm

The map (Figure A) shows the four different real estate transactions by the Stonebridge Property Group in November 2019.

There were 33 west side neighborhood rental properties acquired in three different portfolios, and the fourth transaction was for a single downtown property:

Portfolio A: Purchase Price of $4,390,000 (11/19/19)

1. 12 Ayres St

2. 135 Chapin St

3. 136 Chapin St

4. 137 Chapin St

5. 140 Chapin St

6. 5 Leroy St

7. 52 Leroy St

8. 59 Leroy St

9. 116 Murray St

10. 79 Oak St

11. 101 Oak St

12. 28 Seminary

Total Assessed Value $976,400

Portfolio B: Purchase Price of $2,300,000 (11/20/19)

1. 149 Chapin St

2. 135 Front St

3. 141 Front St

4. 151 Front St

Total Assessed Value $418,900

Portfolio C: Purchase Price of $2,685,000 (11/21/19)

1. 13 Florence Ave

2. 56.5 Leroy St

3. 58 Leroy St

4. 60 Leroy St

5. 79 Murray

6. 77 Oak St

7. 8 Seminary Ave

8. 12 Seminary Ave

9. 51 Seminary Ave

10. 52 Seminary Ave

11. 39 St John Ave

12. 8 Walnut St

13. 11 Walnut St

14. 13 Walnut St

Total Assessed Value $858,900

Single Property Transaction D: $1,505,000 (11/20/19)

1. 40 Court Street

Assessed value: $291,700

Most of the properties acquired by the NYC equity firm are listed as available rentals by KO Management, a student rental management firm run by members of what I’ll term the downtown “Colonial Club,” the savvy crew of Binghamton University students behind the Colonial restaurant and a growing empire of real estate and commercial ventures in the Binghamton area. The office of KO Management is at 40 Court Street, one of the buildings included in the deal. The NYC equity firm paid $1,505,000 just for this one property, which is more than 5x what the City has it assessed at. According to County online records, 40 Court Street was previously owned by an LLC traced back to Ron and Alice Kweller, two of the founding members of the brain trust behind the “Colonial Club.”

Part 2. The Harms of an Outdated, Inequitable Assessment System

Nothing about these transactions is unethical. A NYC equity firm analyzed the numbers, saw a windfall of profits in student housing, and made a nearly $11 million investment into neighborhood student rental properties and a downtown property.

But these particular real estate transactions help illustrate some of the serious problems with our rental housing market and our city property assessment system overall that demand attention and action by our local officials.

I wrote an article in September 2019 about our broken property assessment system, which hasn’t been updated since 1993—one of the most outdated assessment systems in the entire state. In that article, I explain how the beneficiaries of Binghamton’s outdated assessments are two groups of owners whose properties, especially over the last decade, have greatly increased in value: downtown developers and landlords of student rental properties. I also offer some policy recommendations that would not only make our assessment system more equitable, but also improve housing opportunities for all residents.

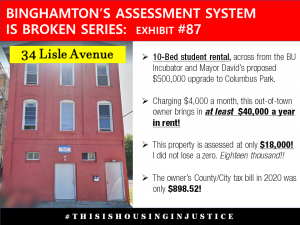

Over the last sixteen months, I’ve provided many examples of neighborhood properties that have been converted from owner-occupied homes or small mom and pop rentals to 8-12 bed student housing. Many of these student rental properties now make $30,000 to $60,000 a year in revenue but still pay tax bills on an assessment trapped in a 1990s time warp (see image below, and this online photo album for more examples).

But these purchases by an NYC equity firm make the case stronger than I ever could.

The simple truth is that private market and outside investors are paying 3 to 6 times the assessed values of student rental properties, knowing they can make hand-over-fist charging by the bed and yet still pay absurdly low—criminally low—tax bills.

The inaction by local officials to fix our broken, inequitable assessment system means almost all other property owners are paying more taxes than they would under a more equitable assessment system. Inaction by local officials also means that investors will always be tempted to transform more and more of our rental housing market to accommodate students, making it harder and harder for non-students, like local families and individuals on limited monthly budgets, to find decent, affordable rental housing.

This train wreck is only going to get worse.

Part 3. What Would it Mean to Restore Equity and Fairness to Binghamton’s Assessment System?

By paying more than 400% above the combined assessed values of the 34 properties, this private equity firm showed us clearly how much the private market truly values Binghamton’s student rental and downtown properties—and how much they benefit from an assessment system that is more than 30 years old.

Recall, the downtown property at 40 Court Street. The NYC corporate owner who just paid more than $1,500,000 for this downtown property, is happily paying local and school taxes on a pathetically low assessment that isn’t even $300,000.

It’s outrageous.

Clearly, our assessments are outdated—we all know the markets for downtown real estate and student rental properties have skyrocketed in value the last 10 years.

My pleas over the last two years for city officials to conduct a citywide revaluation in order to create an equitable and fair system have fallen on deaf ears. But using this $11 million dollar real estate transaction to run some quick numbers, we can catch a glimpse of why this is so urgent and necessary.

While we know the NYC equity firm just paid more than four times the cumulative assessed value of the properties, let’s just take a very conservative approach and assume the assessed values on these 34 properties were only doubled.

Just doubling the assessments of these 34 properties would generate about $72,000 more in property tax revenue for the City, and $90,000 for the Binghamton City School District.

That’s not peanuts–and that’s only a tiny-step toward bringing the assessments of only 34 properties into closer alignment with today’s market values.

But here’s the most important point, readers: that doesn’t mean the City has $72,000 more tax dollars to spend. It means that the City has the choice to reduce the tax burden of other property owners by $72,000.

When we fix the assessment system citywide to accurately reflect market dynamics, wealthy downtown developers and landlords of high-value student rental properties will have a much higher tax burden. That means city officials could lower the tax burden by the same amount for others.

A revaluation could help lower the tax burden for many elderly couples or senior widows on the East Side and in First Ward.

A revaluation could help lower lower the tax burden for many families buying old starter homes in neighborhoods that have seen no appreciation (or even depreciation).

A revaluation could help lower the tax burden for many mom-and-pop landlords who continue to rent to non-students.

This is what an equitable assessment system looks like.

The goal of a citywide revaluation is not to increase everybody’s assessment in order to raise more tax revenue. A citywide revaluation is about making sure today’s tax burden is distributed equitably and fairly across all properties.

If just 34 properties sold for $8.3 million more than their current combined assessments, just consider how massive this problem is citywide. I suspect Binghamton’s assessment system is likely underassessing downtown properties and student rental properties by nearly $200,000,000 dollars.

Whether my estimation is too low or too high, the key point is this: the assessments (and tax burden) of all other property owners could be reduced by that same amount.

But local officials, specifically Mayor Rich David, have made it perfectly clear: there will be no mention or even acknowledgement of this inequitable system. Mayor David’s response is no surprise. He is best buddy with both of the crowds that profit obscenely off this broken, outdated assessment: downtown developers and student rental providers. City Council has been under the control of Republicans for years, and GOP President after GOP President has shown no interest to even discuss the issue.

That’s tragic and pathetic, because political inaction is not just denying us a chance to create a more equitable property tax system. Inaction from local leaders is also incentivizing rental property owners to market only to students, which is harming our local families, couples, and individuals and making it extremely difficult for them to find quality, affordable rental housing.

Look, if an investor owns a two-family, with decent 2-BR units, and they’re going to pay the same amount in property taxes no matter how they use their real estate asset, then basic economics (or their own legitimate needs) tempts them to choose higher profits. They could either rent to two families or couples at $800 per unit, or they could add a bedroom in each unit, market to students, and charge $500 per bed. That’s either $1,600 a month renting to local families, couples, or individuals, or $3,000 renting the units to students (6 bedrooms).

Could fixing the assessment system not only ensure we have equity and fairness in how we distribute the tax burden across all properties, but also improve the rental housing market for non-students and the landlords that rent to them? I think so. Here’s why.

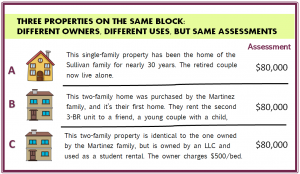

Let’s create a case study of three Binghamton properties close to each other in a specific neighborhood, and compare their assessments and property tax bills before and after a citywide revaluation. There is of course limitations to this simple hypothetical exercise, but it offers a compelling picture of the goals and likely outcomes of a citywide revaluation.

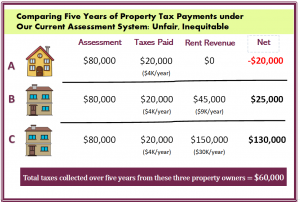

Now, let’s look at the local property tax payments and rent revenue collected over a five-year period by these three owners. The rent calculations assume ten months of rent payments, which is industry standard, and are based on the descriptions above. To clarify, the Martinez family (property B) is charging a family of three $900/month. The LLC owner (property C), is charging $500/bed for both 3-BR units.

The above scenario is all too common in Binghamton. Owners that have converted single- or two-family homes to student rentals and charge by the bed (Property C), are making $30,000 to $60,000 a year but paying the same amount of taxes as a middle-class homeowner, like the Sullivan family (Property A). That is unfair and inequitable.

Also, it’s great that the Martinez family is renting their unit to a young family, which is something City leaders (and all residents!) ought to celebrate and encourage. But the outdated assessment system actually incentivizes owners like the Martinez family to choose instead to rent to students and charge by the bed.

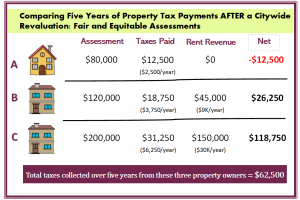

Now, let’s look at what could happen if Binghamton officials showed the courage and leadership to carry out a citywide revaluation.

There are really important points to emphasize here:

- The total assessments of these three properties increased from $240,000 to $400,000, but the total amount of property taxes collected over five years from these three properties is virtually the same!

- In other words, the revaluation, in which new assessments are based on market value and/or the income generated by the property, ensures the tax burden is distributed more fairly and equitably across all Binghamton property owners. And the results are really eye-opening:

- The annual tax bill for the long-time homeowner and retired couple, the Sullivan family, was slashed by more than 35%.

- The annual tax bill for the first-time homeowners, the Martinez family, who use their second unit to house a young family also decreased, by about 6%.

- And while the annual tax bill for the LLC owner of student rentals jumped from $4,000 to $6,250, the investor’s annual net gain dropped only slightly—from $26,000 to $23,750. In other words, these student rental properties owners are still making a profit, just no longer an obscene profit on the backs of other property owners in Binghamton, like the Sullivan and the Martinez families.

So after a revaluation, homeowners and those who rent to non-students will likely see property taxes go significantly down or stay about the same. And a small group of owners of downtown properties and student rental properties will see an increase in property taxes. In other words, for the first time in decades, our local property tax burden will be distributed fairly and equitably.

So what’s not to love?

Part 4. The Powerbrokers Won’t Like This: It’s Up to Us

As the simple scenario above makes clear, a citywide revaluation will help most homeowners (like the Sullivan family), investor-owners (like the Martinez family), and many mom-and-pop landlords.

First, let me state clearly: New York State should step in, and join the majority of other states that mandate local assessors carry out periodic revaluations every three to six years (varies by state). Some state legislators have been trying to fix this broken system for years. Assemblywoman Sandy Galef (D-Ossining) who chairs the Assembly Committee on Real Property Taxation, has introduced a bill every year since 2011 that would require local Assessors to carry out revaluations every four years. According to Galef, one of the biggest roadblocks to equitable reform is Governor Cuomo, a smooth-talking progressive-wannabe who remains all too cozy with big money and the real estate industry (this author’s characterization, not Galef’s).

Absent a state mandate, advocacy (and true political leadership) at the local level is the only way to restore equity and fairness to our broken property assessment and tax systems.

Unfortunately, any local effort to bring the assessment system out of the 1990s time warp and make sure the tax burden is distributed fairly across all property owners will face the same challenges as Galef faces on the state level.

For sure, any such proposal will be met with howls by owners of downtown properties and student rental properties. So used to profiteering at obscene levels, this small group of powerful property owners will almost certainly launch a well-funded disinformation campaign to mischaracterize this as another “tax grab” by “big spending government” that will harm “us all.”

Don’t fall for it.

First, a revaluation is not meant to raise any more tax revenue than the year prior. The goal is to distribute that tax burden more equitably based on changes in the real estate markets. So if the City is raising $35 million in local property taxes today, it should raise the same amount after a revaluation.

Second, and as the example above illustrates, anybody who is NOT an owner of a downtown property or student rental property will likely see their tax bill stay the same or go down following a citywide revaluation. And that’s the overwhelming majority of property owners in Binghamton.

But just as our problematic Governor stands in the way of state reform, our problematic Mayor stands in the way of local reform—after all, this small group of investors profiting significantly off our broken system are Mayor David’s best friends, his drinking buddies (possibly even his secret investment partners).

Fortunately, our “downtown developer and student rental investor” Mayor will be out of office by the end of this year. It is up to the residents of Binghamton–including homeowners, small landlords, and tenants who are sick of being crowded out by student rentals–to demand Binghamton leaders finally fix our unfair, inequitable, and broken property assessment and tax systems.

It has been almost 30 years since our assessments have been updated citywide. We’ve waited long enough.

Readers: If you found this article informative and useful, please share it with other Binghamton property owners, through social media networks like Facebook and NextDoor, and your personal networks. Thank you.