I live next door to a zombie, and I worry that trouble is coming this summer.

The zombie is a single family residence with three bedrooms and about 1,700 square feet of living space. The owner defaulted on the mortgage a couple years ago, and before he moved to Texas, he offered the house up to a nice family from his church that was in need of housing.

“Probably going to take a couple years for the bank to finish the foreclosure, so might as well let them stay for free,” I remember him saying before he departed to Texas. I always liked him.

The family was nice as well, and my son and the three kids played often when the weather was nice. But about six weeks ago, they up and moved, as the mortgage foreclosure process was apparently winding to a close and the house started to show signs of neglect (the bank wasn’t handling maintenance and as squatters, they certainly had no reason to).

Now the zombie home sits empty. The jungle that overgrew the backyard last fall is ready to make a return. A couple of doors don’t appear to be fully secured, and a window in the back has already been smashed. But I ain’t going down without a fight, and this post is meant as a resource to any other resident (tenant or homeowner) that shares a street with a zombie home. Below is a “How To Guide” for NY residents to identify, confirm, and report zombies to local and state authorities.

First, let’s clarify what we mean by zombie: a vacant home that is “stuck” somewhere in the mortgage foreclosure process, either because of the bank’s inaction or delays (at times, purposeful) or the very slow nature of the mortgage foreclosure process here in NY.

Properties can become vacant or abandoned for a whole host of reasons, so it’s important to know how to use online databases to identify whether that specific vacant property on your street is actually a zombie.

The reason is because NYS passed a first-of-its-kind “zombie prevention” bill back in the summer of 2016. The law, which has been effective for about two years now, includes the following two key provisions: (1) requires banks and servicers to regularly inspect, secure, and maintain a property throughout the foreclosure process if it becomes vacant, and (2) requires banks and servicers to register that property with the state as it moves through the foreclosure process (for the policy nerds out there, check out this powerpoint presentation by New York Conference of Mayor’s General Counsel to learn more about the bill).

Administration and enforcement of the program is the responsibility of NYS’s Department of Financial Services, and they work closely with local code enforcement offices to verify whether properties should be on the “zombie registry” or already are. They can bring the hammer down on the banks and servicers if needed, so that’s why it’s important for residents to be aware of the process, and take action.

So let’s get into it….

Step 1. Who Owns the Property?

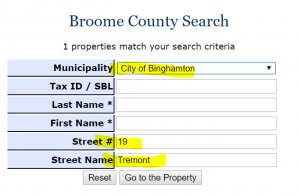

Suppose I just relocated to Tremont Avenue on the southside of Binghamton and noticed that 19 Tremont was vacant and showed signs of abandonment as well. First thing I got to do is figure out who owns the property.

I google “IMO Broome County” (https://imo.co.broome.ny.us/index.aspx), and click “CLICK HERE FOR PUBLIC ACCESS,” which is pictured below.

Then, I add the property address into the search tool, and click SEARCH.

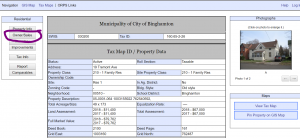

There’s a lot of information one can access here: owner, the history of sales (to whom and for how much), a description of the property, assessment and tax payment data, and more. For our purposes, tracking down the owner name to assess whether this is a zombie, we want to click OWNER/SALES on the left menu.

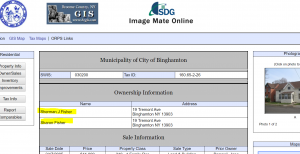

That takes me to a list of all the sales and owner information, and the current owner is listed on top. As pictured below, we find personal names for owners (not LLCs), and the mailing address for the owners is the actual residence (not some out-of-town address or local PO Box). Both of these are definitive signs that they are/were homeowners–not renters or landlords.

We got the name of the owner, now we need to move to another online database maintained by Broome County and see if they’re subject to a mortgage foreclosure action.

Step 2. Has the bank started a foreclosure action?

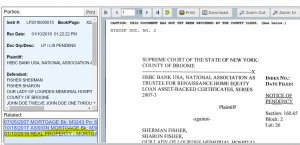

A lis pendens is the first filing made during the foreclosure process. It’s like a heads-up to all parties involved, and court documents like these are required by law to be recorded by County Clerk Offices across New York. Fortunately, Broome County maintains an online records portal that is reasonably accessible and reliable.

So go to the webpage for the Broome County Clerk’s Office and from the main menu on the left sidebar, choose the item “gobcclerk.com” (see below). Once there, choose “LOG-IN AS GUEST.”

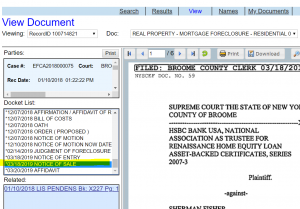

This portal is a bit intimidating at first, and the search feature is a bit cranky. You may need to try multiple different variations of the name (or company) before you find what you’re looking for. For this case, I type in the homeowner’s name, last name first (“Fisher Sherman”), and click search.

Note that, as the below image shows, any and every court record or document pertaining to this individual will be available for public review.

(For example, and picking something that’s been in the news recently, Republican candidate for Broome County District Attorney Paul Battisti was recently questioned about tens of thousands of dollars in outstanding federal tax liens against him for non-payment of taxes. How did folks find out? All of the records are right here in this database. Try it yourself. Search ‘Battisti’ and choose “Federal Tax Liens” for document category, and there you go. Every lien, including his political decision to quickly pay off right after the news aired. Anyway, back to our zombie…)

So you can see that the lis pendens was filed January 10, 2018 by HSBC. Write this down, since you’ll want to know the bank and date of the lis pendens when you file the complaint with the state (not required, but helpful), which is described below under Step 3.

Foreclosures in NY can take 14 – 24 months, so it’s not surprising that the foreclosure started more than 15 months ago. But the portal also shows you all related files, and for mortgage foreclosure’s there’s always a Master File under which all subsequent forms, documents, and court actions will be chronicled. So if you want to see where the foreclosure is in the process, find that file. For 19 Tremont, it’s one of the listed links under “Related” (see highlighted):

Once I have the Master File, I can now scroll down and see every action in this foreclosure proceeding and the timeline.

Good news is that it looks like it’s near the end, but it could still be months before the bank sells the property to another investor or owner. So now what?

Step 3. Report the zombie to the State and Local Authorities.

You’ve confirmed the property is a zombie (vacant and at some point in the mortgage foreclosure process), so now you need to report the zombie to both state and local authorities.

- File a complaint with NYS DFS. This department is responsible for managing the zombie registry and enforcing the zombie law. As part of this effort, they created a “Zombie Hotline” and an online portal. I think the online portal is better because you know a paper trail will be established. Here is the Customer Complaint page, and the process is pretty straightforward. They will send you a confirmation email, and will keep you posted on progress via snail mail and email. I even had the rep call me during the review process after I reported a zombie on behalf of a resident on the East Side.

- Report the zombie to the local Code Enforcement Office. Assuming it’s Binghamton, either by mail (see online request form) or phone (772-7010) report your concern of a zombie property and provide the address. Notify them that you also submitted a complaint to NYS DFS about the zombie. Ask them to please keep you posted with updates.

Job Well Done

That’s it for now, zombie hunters. Sit back and see how things unfold. Better yet, keep me posted on your actions, and let me know if you’ve been seeing positive action. I’ll post some updates on this case of 19 Tremont as well, here at The Bridge, when they come in.

Note, this is just one type of vacant properties, and each type requires a different approach. So if you have any questions about this or other vacant property issues, feel free to email me at tabdelazim73@gmail.com. Happy to share some insights and recommendations on how to address.