The primary revenue source for the City of Binghamton–as with most local governments–comes from local property taxes. For example, in 2019, the City collected $35 million in local property taxes, which alone covered more than half of the $64.5 million general fund operating budget.

[Yes. Worst intro ever. I know. But trust me: the research and graphics below are mind-blowing. Stay with me.]

Given the significance of this one revenue source, it’s important to know the one person, the City Assessor, who is charged with making sure that the formula to collect property revenue is fair and equitable.

Unfortunately, there’s a problem: the City’s property assessment system is outdated, completely broken, and in desperate need of repair. Unless of course you own a student rental property or a downtown property. In that case, it’s working just fine.

How did we get here?

Our Assessment System: Outdated and Neglected

Most states require local or county assessors to conduct citywide “revaluations” every three to five years. A revaluation is a systematic and comprehensive review of the value of all parcels to ensure that the tax system is fair and equitable. That makes sense, since the market values of properties in certain neighborhoods can shift dramatically in five years or less.

For example, maybe a planned baseball stadium causes massive speculation and spike in market values of the properties in the surrounding neighborhoods. Maybe new flood maps significantly depress the market value of homes in an otherwise, historic stable neighborhood. Maybe a struggling downtown suddenly comes alive, attracting massive private investment to convert empty commercial buildings into luxury loft apartments.

The point is that all neighborhoods are always shifting, and after a few years, some properties will be over-assessed and some properties will be under-assessed. That’s why state-mandated periodic reviews of citywide property assessments is the norm across the country.

New York, however, bucks the trend: there is no state law requiring periodic revaluations. New York is one of the only states in the nation that leaves this process to chance.

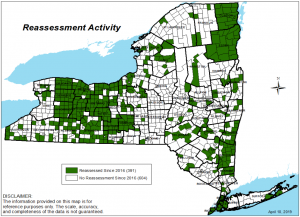

And chance has not been good to Binghamton. While approximately 40% of all municipalities have completed revaluations in just the last three years (see map below), the last time the City of Binghamton underwent a citywide revaluation was in 1993–more than a quarter century ago!

Based on a list compiled by the NYS Department of Taxation and Finance, you can scroll through 22 pages of municipalities and only find a couple dozen with more outdated assessment systems than Binghamton–and most of them are rural towns or villages with little change in market activity for decades.

But as we all know, the real estate market in Binghamton has seen three significant trends in the last ten years:

- A Resurgent Downtown. The downtown has exploded in vibrancy and activity since 2008, and underutilized commercial buildings have been transformed to accommodate thousands of college students and professionals. The shift has definitely affected market values. Just look at the building that housed the former Dollar Store at the corner of Court and State Streets. Rich David, our Mayor, purchased the property in 2010 for $655,000. He sold it seven years later for $1.23 million.

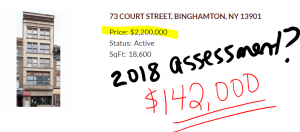

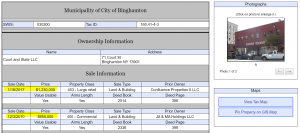

At the time of sale, it was still assessed at $397,000–a HUGE deviation from market value. There are plenty of examples of downtown properties that are still assessed as if “empty” or “underutilized” commercial properties in a “dead” downtown, even though they’ve been re-purposed and are now generating tens (or even hundreds) of thousands of dollars a year in rental revenue–and some are being listed for sale or sold at 2-10 times the “current” assessment.

- Residential Conversions: from family homes to student rentals. Single or two-family residential properties, that used to be owner-occupied, have since been carved up into 5-10 bed student rentals. These properties continue to be assessed as if modest homes for widows, seniors, or young working families, even though these properties are now generating $20,000 to $40,000 a year in rental income–and like downtown commercial properties, attracting HUGE purchase offers on the open market.

- Climate Change and Floods. There are a couple thousand residential and commercial properties all across the city that may be newly incorporated into revised flood maps, which would mean significantly higher flood insurance premiums. While the impacts are still unknown, the threat of future flood insurance premiums could significantly dampen the market value of residential and commercial properties in certain flood-prone areas.

The purpose of this article is to provide more concrete evidence of the first two trends mentioned above (I assume most folks can appreciate that the new flood maps could significantly impact the value of properties in new and expanded floodplains).

Because I think it’s more than fair to assume most folks don’t truly appreciate how uneven, unfair, and inequitable our assessment system is when it comes to downtown properties and student rental conversions. It’s not like this is what we discuss at family dinners or on the benches or bleechers while watching our kids play.

So let’s start with the student rentals, but a quick example first to put this in perspective. Here’s my single-family home side-by-side another modest home that’s been converted to a student rental. Even though this student rental can generate more than $40,000 a year in rental income (based on actual apartment listings), the owner pays less in taxes than I do. That’s ridiculous.

But this is not about my tax bill. This problem is systemic. Our outdated, inequitable assessment system burdens thousands of homeowners, and blesses downtown developers and landlords of student rentals.

In order to more accurately capture and present this broken system, I occasionally conducted online spot-checks of Binghamton apartment listings for about six months. I recorded and researched more than 60 student listings–and I barely scratched the surface. For each apartment listing that was renting by the bed, I recorded address location, number of bedrooms, and rental fee per bed. I then researched the property’s assessment, as well as recent sales, on the County’s IMO database. The examples below are just a SAMPLING of what was found, and point to a number of policy questions and, in my mind, recommendations, to ensure a FAIR and EQUITABLE assessment system.

I acknowledge there are limitations to my methodology. For instance, I calculated maximum annual rental revenue by multiplying the known monthly revenue by 12 months, even though most rental properties are vacant 2 months out of the year. On the other hand, it was clear that some buildings had other multi-bed apartments, but I couldn’t always discern the exact number of units. Thus, the estimated annual rental revenue is based on only the units listed online–for some of these buildings, with other units, the rental revenue will be significantly higher.

Student Rental Research: Findings

1.) 58 North Street

Assessment: $65,000

2018 County + City Tax Bill: $2,090

Beds Listed: 16 @ $450/bed

Maximum annual rental revenue: $86,400

2.) 2 Chapel Place

Assessment: $41,000

2018 County + City Tax Bill: $1,319

Beds Listed: 6 @ $650/bed

Maximum annual rental revenue: $46,800

3.) 41 Seminary Avenue

Assessment: $48,000

2018 County + City Tax Bill: $1,544

Beds Listed: 6 @ $475/bed

Maximum annual rental revenue: $34,200

4.) 122 Murray Street

Assessment: $55,000

2018 County + City Tax Bill: $1,796

Beds Listed: 10 @ $450/bed

Maximum annual rental revenue: $54,000

5.) 151 Front Street

Assessment: $90,000

2018 County + City Tax Bill: $4,571 (taxed at non-homestead rate)

Beds Listed: 15 @ $700/bed

Maximum annual rental revenue: $126,000

6.) 150 Chapin Street

Assessment: $80,000

2018 County + City Tax Bill: $4,064 (taxed at non-homestead rate)

Beds Listed: 8 @ $510/bed

Maximum annual rental revenue: $48,960

7.) 80 Oak Street

Assessment: $74,700

2018 County + City Tax Bill: $3,795 (taxed at non-homestead rate)

Beds Listed: 7 @ $500/bed

Maximum annual rental revenue: $42,000

8.) 21 Stuyvesant Street

Assessment: $55,000

2018 County + City Tax Bill: $1,769

Beds Listed: 6 @ $400/bed

Maximum annual rental revenue: $28,800

9.) 20 Edwards Street

Assessment: $61,600

2018 County + City Tax Bill: $1,981

Beds Listed: 8 @ $435/bed

Maximum annual rental revenue: $41,760

10.) 56 Leroy Street

Assessment: $33,500

2018 County + City Tax Bill: $1,056

Beds Listed: 6 @ $400/bed

Maximum annual rental revenue: $28,800

The above examples are just a small sampling, and point to a systemic problem in need of repair. The property owners know it, too. When they put these rental properties on the market, they are typically asking for hundreds of thousands of dollars, and occasionally mention “really low property taxes” in the property description.

But it’s not just the student rentals in our neighborhoods. It’s many of the downtown properties too.

The “Downtown Boom” that is Still Assessed as a Bust

Mayor David is so happy to tout that he “transformed” downtown into a vibrant hub of commerce, culture, and activity. And his characterization of downtown is not wrong. It has transformed, thanks to more than two decades of stubborn and dedicated small business merchants, artistic innovators, catalytic investments from developers, and smart public policy and investments that finally achieved a tipping point (sorry, Mayor, you can’t take all the credit, silly man).

But the assessments, as if locked in some 1990s time warp, haven’t come close to catching-up with the market trends. To make matters worse, these systemic under-assessments are being used by the Assessor as “comparables” to justify requests by downtown property owners to lower their assessments even further, including a very personal (and unethical) request by Mayor Rich David (but more on that later).

But don’t take my word for it. A quick scan of current downtown property listings shows how outrageous the gap is between assessed values and market listing prices. Here are four listings that were active at the time this article was published.

The difference between what the Binghamton Assessor is valuing these properties and what the market is willing to pay is massive, outrageous, and grossly inequitable.

It means that the property tax bill of an 83-year old widow in the First Ward is higher than it should be because either our Assessor or Mayor (or both) don’t care to fix a broken system that works perfectly for owners of downtown properties (like the Mayor). It means that a new family, owning their first home on the East Side, is paying more in local property taxes to protect the obscene profits of a landlord of a West Side student rental property who is pulling in tens of thousands of dollars in rental income a year.

Mayor David and his rubber-stamping GOP Council might want to perpetuate this inequitable system. And the City Assessor, who Mayor David will likely appoint for another six-year term, is clearly on board with the status quo, a “see no evil, hear no evil, speak no evil” approach of willful ignorance.

Anybody else care to defend this whacked, inequitable assessment system? Not me.

Conclusions and Recommendations

There are a number of conclusions one can draw from the above.

The most obvious is that our current assessment system is unfair, inequitable, and in desperate need of repair. There’s no reasonable defense of a broken, outdated system that hasn’t been comprehensively reviewed for 26 years.

And the result of this collective negligence by the Assessor and our political leaders is clear: Homeowners in the neighborhoods and small business owners are subsidizing wealthy downtown developers and landlords of student rentals. If the city assessment system accurately valued downtown properties and 5-10+ bed student rentals in our neighborhoods, by either the market value approach or the income approach, these properties would be assessed at significantly higher rates—contributing more in taxes and relieving some of the tax pressure on all other property owners.

The City Assessor, has been serving in his position since 2007, and has offered little but lip service to effectively address these three significant shifts in the city’s real estate market. (I know. I was there.) And I don’t suspect Mayor Rich David is chomping at the bit to change a system that benefits him and his downtown and landlord buddies.

The Assessor’s six-year term ends this September 30, but don’t get your hopes up. It’s likely Mayor David will re-appoint him to another six-year term. Not only does the Mayor appreciate the Assessor’s inaction on our broken assessment, but David also appreciates the Assessor’s willingness to bend ethical standards for “the boss.” As reported exclusively here on The Bridge earlier this year (article), the Assessor quietly reduced the assessment on Mayor David’s downtown residence by 27% months after David’s re-election. A more critical review of the questionable assessment reduction also uncovered a STAR exemption that the Mayor was illegally benefiting from, which again was featured here at Binghamton Bridge (article). In public statements, the Mayor said he was encouraged to apply by the Assessor and thus assumed everything was legit. The Assessor later explained “he wasn’t aware of the rules and made a mistake,” even though the STAR exemption is the most popular and widely used tax break program in the state.

The sampling above points to a few other policy considerations:

- Mayor David should not re-appoint the current City Assessor, who has served 12 years—exactly when the major market shifts have occurred in Binghamton—and apparently done nothing to address the problem, let alone acknowledge and raise awareness of the problem. Mayor David should use this incredible opportunity (comes only once every six years) to recruit a new Assessor, not from this area, that is committed to and experienced with the revaluation process.

- The City needs to conduct a revaluation as soon as possible, and precede the work with a very robust and inclusive community outreach and education campaign to make clear that the goal of a revaluation is not to generate more tax dollars, as critics will inevitably charge, but to ensure the assessment system is FAIR and EQUITABLE. As part of the process, the City should explore eliminating the “split” tax rate (homestead v non-homestead), finally ending an assessment system that places undue burden on small businesses. Once the revaluation is complete, models for retaining and eliminating the two-tier tax rate system ought to be developed so policymakers, elected leaders, and property owners can better understand the benefits and drawbacks of each before making a final decision.

- Alongside a revaluation process, the City should finally implement and enforce the rental registration and permit program that’s been on the books since 2013, but rejected and ignored by the David administration. The revaluation process and rental inspection program share similar means to different ends. Both want to gain access to rental properties to better understand the conditions, state, and make-up of the units. The assessment wants to assign the right value, the inspector wants to protect the health and safety of tenants. Linking these two processes together would create efficiencies, improve dialogue among all parties, and lead to better outcomes.

- At the state level, elected officials in Albany should mandate that municipal-wide revaluations happen at least once every ten years, joining what is the norm across the country. As mentioned previously, most state laws require revaluations every three to five years, so ten is a very flexible time frame for local officials to adapt to. To help offset the costs of this work, a very small portion of the existing mortgage tax collected by the state should be remitted back to Counties each year into a dedicated “Revaluation Fund.” These funds could be used to cover at least 50% of the costs of the revaluation process.

Finally, I want to make clear that I fully understand and appreciate that many of the landlords and/or developers of the properties featured in this article have made substantial investments in what were substandard properties. That’s great, and I applaud the investment–but it doesn’t mean you’re owed low assessments and low tax bills in perpetuity.

Here’s where we need to be honest (and open to bold solutions). See, these investments point to a systemic and pervasive problem in the rental market, particularly in historically disinvested neighborhoods: that the only way significant investments in substandard properties “pencil out” is if you no longer rent to a family, and instead, carve the property up into 5,8,or 12 bedrooms and charge by the bed.

That’s the owner’s prerogative, I get it, and the conversion from a 3-BR family rental to an 8-BR student rental is almost inevitable, in an unregulated, free market economy (and if not, then allowing the property to slide into decline while milking every last rental dollar from the deteriorating units is another very “attractive” alternative).

That the market dynamics strongly push property owners toward both profitable and inequitable outcomes, is something we need to admit. If so, then we should also admit that we need to design and implement new public policies to give renting to families, particularly low-income families, a competitive advantage over renting to eight or eleven students by the bed.

I see this dynamic and challenge in communities I visit all over the country, so this is by no means a problem “isolated” to Binghamton (because it’s called capitalism). But we need to talk it into the open with honesty if we ever hope to solve it.

There are some innovative policies and programs to explore to address the inequities in our current rental housing market, but right now, the immediate goal must be increasing awareness about how whacked, unfair, and inequitable our current assessment system really is.

For years, owners of properties downtown and student rentals in our neighborhoods have been extracting millions of dollars from Binghamton’s real estate on the backs of long-time or brand-new Binghamton homeowners in every neighborhood. They’ve also been making it more difficult for non-student renters to find housing. They rake in tens of thousands of dollars in profits, and happily pay tiny amounts of local taxes on laughable assessments that are from the 1990s and grossly undervalued.

It’s time to call bullshit. And to hold accountable those officials, including the City Assessor, who refuse to bring fairness, reason, and equity to our property assessment system.

[Note to local media: As author, I permit you full and exclusive use of any and all content, graphics, research without any attributions to me or this website. Please, just go report this shit. Thank you.]

Call to Action

If you feel the City ought to take immediate steps to fix a broken, unfair, and inequitable assessment system, please contact the officials below. In addition to expressing your desire for a fair and equitable system, make it clear to Mayor Rich David that he should not re-appoint the current Assessor for a third six-year term later this month, and that it’s time to restore integrity, diligence, and ethics to the Office of Assessment by bringing in a new Assessor.

- Office of Mayor Rich David: (607) 772-7001

- Office of City Assessor Scott Snyder: (607) 772-7002

- City Council President Tom Scanlon: (607) 772-7234 (fair warning: he’s not big on responding)

Or, feel free to submit a letter to the editor to the local newspaper.

At the time of sale, it was still assessed at $397,000–a HUGE deviation from market value. There are plenty of examples of downtown properties that are still assessed as if “empty” or “underutilized” commercial properties in a “dead” downtown, even though they’ve been re-purposed and are now generating tens (or even hundreds) of thousands of dollars a year in rental revenue–and some are being listed for sale or sold at 2-10 times the “current” assessment.

At the time of sale, it was still assessed at $397,000–a HUGE deviation from market value. There are plenty of examples of downtown properties that are still assessed as if “empty” or “underutilized” commercial properties in a “dead” downtown, even though they’ve been re-purposed and are now generating tens (or even hundreds) of thousands of dollars a year in rental revenue–and some are being listed for sale or sold at 2-10 times the “current” assessment.