Outside Corporate Investors Feast on Rental Market, Exploiting

Binghamton’s Outdated Assessments

Enough is Enough: We Need a Citywide Re-Assessment

That is Fair to all Property Owners

BINGHAMTON – Amicus LLC, registered with the New York State Department as a foreign corporate entity, is the latest outside institutional investor to quietly feast on Binghamton’s rental housing market.

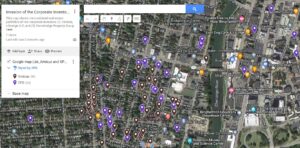

Over three months last fall, from September to November (2021), Amicus purchased 56 student rental properties and a few downtown properties, paying more than $23.3 million for a portfolio that has a combined assessment of only $4.68 million.

This comes on the heels of a private equity firm from downstate that has made major plays in Binghamton’s student rental and downtown real estate market. Since July 2019, Stonebridge Property Group LLC has spent $23.64 million acquiring 35 student rental and downtown properties that the City has assessed for only $4.285 million. (See my February 15, 2021 article, “NYC Equity Firm Makes Multi-Million Dollar Bet on Binghamton’s Student Rental Market: Outdated, Inequitable Assessment System Exposed”)

What does it mean that both corporate investors, together, are valuing the properties at about 520% more than the City’s assessments? It means these wealthy institutional investors are paying a pittance of the taxes that they ought to be paying if Binghamton actually had a fair, equitable, and current assessment system.

The last time Binghamton updated assessments citywide was 1993, which is one of the most outdated assessment systems in all of New York State for cities with a population greater than 30,000. (See my September 17, 2019 article, “Binghamton’s Assessment is Broken and Inequitable; but Working Just Fine for Landlords of Student Rentals and Wealthy Downtown Developers”)

A financial analysis of all 91 properties, made possible from data provided online, shows just how whacked and harmful the City’s outdated assessment system is to other local taxpayers, particularly homeowners (and this trend is causing a lot of harm to non-student tenants, but that’s for another article).

Using 2021 assessments and the 2021 Binghamton tax rate, the two outside corporate entities are paying the following city taxes in 2022 for their windfall-generating, student rental portfolios:

- Amicus, $190,692

- SPG LLC, $174,630

However, if the City’s assessments were equal to what these two corporate entities just paid for the properties (which is exactly what fair, accurate assessments should be), then these two corporate entities would be paying the following in city taxes:

- Amicus, $950,711

- SPG LLC, $963,402

In other words, if Binghamton finally carried out a citywide revaluation so that assessments accurately reflected current market value, then these two corporate investors would be paying about $1.55 million more in city property taxes on their sizable student rental portfolios.

The financial summary can be reviewed here.

BIGGEST MISUNDERSTANDING OF CITYWIDE REASSESSMENTS

And just to be clear: that wouldn’t be $1.55 million in additional, new tax revenue to the City.

Citywide revaluations are not meant to raise new revenue, but instead are carried out to ensure the tax burden is distributed equitably and fairly based on current market values.

Suppose the City collected $32 million in property taxes in 2022, and took this year to carry out a citywide revaluation. In 2023, the City would still only collect $32 million in property taxes. What would change is how the tax burden of $32 million is distributed across all property owners.

As explained by the NYS Comptroller’s Office here, “Reassessments don’t increase the amount of taxes that need to be collected by local governments.” Thus, if a citywide revaluation determines Amicus and SPG must pay $1.55 million more in local taxes, then that same amount – $1.55 million – would be redistributed as tax relief to other Binghamton taxpayers whose property values didn’t jump as much, stayed flat, or even declined.

Binghamton homeowners will absolutely be the overwhelming beneficiaries following a citywide revaluation.

That’s a significant amount of tax relief directed largely to Binghamton homeowners, and this scenario with Amicus LLC and SPG LLC involves just 91 student rental and downtown properties.

There are likely an additional 500 to 1,000 student rental and downtown properties that, when properly assessed to match their current market values, would add millions of dollars to the TAX RELIEF BUCKET. A citywide revaluation will not only make owners of student rental and downtown properties pay their fair share, but also generate a significant amount of tax relief for homeowners and other property owners across the city.

It’s no surprise former Binghamton Mayor Rich “Real Estate” David, whose circle of friends were owners of downtown and student rental properties, announced publicly that he had no interest in fixing the city’s broken assessment system.

As this trend only worsens, one can only hope the new Kraham administration prioritizes what is fair and just, and sides with local homeowners instead of contribution-wielding downtown developers and out-of-town corporate real estate investors.

Maybe current Council members and Mayor Kraham can find inspiration from Niagara Falls. This past December, Niagara Falls City Council voted to carry out a citywide revaluation for the first time in 15 years. In explaining his support for the resolution, Republican Council member John Spanbauer said, “I don’t care if I don’t get elected again. The reassessment is the best thing for this city, and we have dragged our feet too long to do it. We have not had the political will.”

With assessments that are nearing 30 years old in Binghamton, homeowners can only hope our leaders finally muster the same political will.

Tarik Abdelazim, who served as Binghamton’s Director of Planning, Housing and Community Development from 2010 through 2013, has been researching housing market trends for the last few years, advocating strongly for a citywide revaluation that he argues is essential to creating a more equitable and just housing ecosystem in Binghamton. Abdelazim will be emailing his financial analysis and a copy of this article to all seven Binghamton City Council members and Mayor Jared Kraham.